UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

| | | | | |

Filed by the Registrant x | Filed by a Party other than the Registrant o |

Check the appropriate box:

| | | | | |

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Pursuant tounder §240.14a-12 |

CONSTRUCTION PARTNERS, INC.

(Name of Registrant as Specified in its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box)all boxes that apply):

| | | | | | | | |

| x | No fee required. |

| o | Fee paid previously with preliminary materials. |

| o | Fee computed on table belowin exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

o | Fee paid previously with preliminary materials. |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON TUESDAY, FEBRUARY 22, 2022WEDNESDAY, MARCH 20, 2024

NOTICE IS HEREBY GIVEN that the 20222024 Annual Meeting of Stockholders (the “Annual Meeting”) of Construction Partners, Inc. (the “Company”) will be held on Tuesday, February 22, 2022,Wednesday, March 20, 2024, at 9:11:00 a.m., Central Time, at the DoubleTree by Hilton, Garden Inn, located at 171 Hospitality Lane,2740 Ross Clark Circle, Dothan, Alabama 36303.36301. The Annual Meeting is being held for the following purposes:

1.to elect three Class IIII directorsto serve for a three-year term expiring at the 20252027 Annual Meeting of Stockholders;

2.to ratify the appointment of RSM US LLP as the Company’s independent registered public accountantsaccountant for the fiscal year ending September 30, 2022;2024;

3.to approve the adoption of the Construction Partners, Inc. Employee2024 Restricted Stock Purchase Plan;

4.advisory, non-binding vote on executive compensation;

5.advisory, non-binding vote on the frequency of future votes to approve executive compensation;an amendment to the Construction Partners, Inc. 2018 Equity Incentive Plan to increase the number of shares reserved for issuance pursuant to awards; and

6.5.to transact such other business as may properly come before the Annual Meeting or any adjournment, postponement or recess thereof.

The Board of Directors has established January 3, 202222, 2024 as the record date for the Annual Meeting. Only holders of the Company’s Class A or Class B common stock at the close of business on the record date are entitled to notice of, and to vote at, the Annual Meeting and at any adjournments, postponements or recesses thereof.

This proxy statement provides you with detailed information about the proposals to be voted on at the Annual Meeting. With this proxy statement, we are also including a copy of our 20212023 Annual Report on Form 10-K (the “Annual Report”) in order to provide you with additional information about the Company. We encourage you to read this proxy statement and the Annual Report carefully.

The Annual Meeting may be adjourned from time to time without notice other than announcement at the Annual Meeting, and any business for which notice is hereby given may be transacted at any such adjournment.

| | | | | |

| By Order of the Board of Directors, |

| |

| Ned N. Fleming, III |

| Executive Chairman of the Board of Directors |

| Dothan, Alabama |

| January 12, 202226, 2024 |

TABLE OF CONTENTS

| | | | | |

| Page |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Delinquent Section 16(a) Reports | |

| |

| |

| |

| |

| |

| |

| |

| |

| | | | | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Appendix A: Construction Partners, Inc. 2024 Restricted Stock Plan | |

| |

| |

| |

| |

CONSTRUCTION PARTNERS, INC.

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD TUESDAY, FEBRUARY 22, 2022WEDNESDAY, MARCH 20, 2024

This proxy statement (the “Proxy Statement”), along with the accompanying Notice of Annual Meeting of Stockholders (the “Notice”), is furnished on behalf of Construction Partners, Inc. (the “Company”) by its board of directors (the “Board”) and management in connection with the solicitation of your proxy to be voted at the 20222024 Annual Meeting of Stockholders of the Company (the “Annual Meeting”) to be held at 9:11:00 a.m., Central Time, on Tuesday, February 22, 2022,Wednesday, March 20, 2024, at the DoubleTree by Hilton, Garden Inn, located at 171 Hospitality Lane,2740 Ross Clark Circle, Dothan, Alabama 36303,36301, and at any adjournments, postponements or recesses thereof.

In this Proxy Statement, unless the context suggests or requires otherwise, references to “the Company,” “we,” “us” and “our” mean Construction Partners, Inc., a Delaware corporation, and, as appropriate, our subsidiaries. References to “SunTx” mean SunTx Capital Partners, a private equity firm based in Dallas, Texas,Texas. SunTx, together with its principals and itstheir respective affiliates which collectively ownand family members (collectively, the “SunTx Group”), owns a controlling interest in our common stock.

We began mailing this Proxy Statement and the accompanying Notice on or about January 12, 202226, 2024 to all stockholders of the Company entitled to vote at the Annual Meeting.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON FEBRUARY 22, 2022MARCH 20, 2024

This Proxy Statement is available for viewing, downloading and printing at www.proxyvote.com. Additionally, you can find a copy of our Annual Report on Form 10-K for the fiscal year ended September 30, 2021 (the “Annual Report”),2023, which includes our annual financial statements, on the website of the Securities and Exchange Commission (the “SEC”) at www.sec.gov, or by following the “Investors - SEC Filings” link on our website at www.constructionpartners.net. You may also obtain a printed copy of our Annual Report on Form 10-K for the fiscal year ended September 30, 2023, including our financial statements, free of charge by sending a written request to the principal executive office of the Company at the following address: Construction Partners, Inc., 290 Healthwest Drive, Suite 2, Dothan, Alabama 36303, Attention: Secretary. Exhibits will be provided upon written request and payment of an appropriate processing fee.

IMPORTANT INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

Why am I receiving these materials?

The Board, on behalf of the Company, is providing these proxy materials to you in connection with the Annual Meeting. Stockholders are invited to attend the Annual Meeting and are requested to vote on the proposals described in this Proxy Statement. This Proxy Statement, along with the Notice, summarizes the purposes of the Annual Meeting and certain information that will assist you in determining how to vote at the Annual Meeting.

What is a proxy?

A proxy is your legal designation of another person, called a proxy holder, to vote the shares that you own. If you designate someone as your proxy holder in a written document, that document is called a proxy. We have designated Ned N. Fleming, III, our Executive Chairman, Fred J. (Jule) Smith, III, our President and Chief Executive Officer, and R. Alan Palmer,Gregory A. Hoffman, our ExecutiveSenior Vice President and Chief Financial Officer, to act as proxy holders at the Annual Meeting as to all shares for which proxies are returned or voting instructions are provided by internet or telephonic voting.

What is a proxy statement?

A proxy statement is a document that SEC regulations require us to give you when we ask you to sign a proxy card designating the proxy holders described above to vote on your behalf.

Who is soliciting my proxy?

This proxy solicitation is being made on behalf of the Company by its Board and management. The cost of this solicitation, including the cost of distributing the proxy materials, will be borne by the Company. Officers and employees of the Company may solicit proxies, either through personal contact or by mail, telephone or other electronic means. These officers and employees will not receive additional compensation for soliciting proxies. Brokerage houses, nominees, fiduciaries, and other custodians will be requested to forward soliciting materials to beneficial owners and will be reimbursed by the Company for their reasonable out-of-pocket expenses incurred in sending proxy materials to beneficial owners.

What is included in these materials?

These proxy materials include:

•the Proxy Statement for our Annual Meeting;

•a proxy card with a prepaid return envelope; and

•our 2023 Annual Report, which includes our audited consolidated financial statements.

This Proxy Statement and form of proxy are being mailed or made available to our stockholders on or about January 12, 2022. The Annual Report does not form any part of the materials for solicitation of proxies.26, 2024.

What proposals will be voted on at the Annual Meeting?

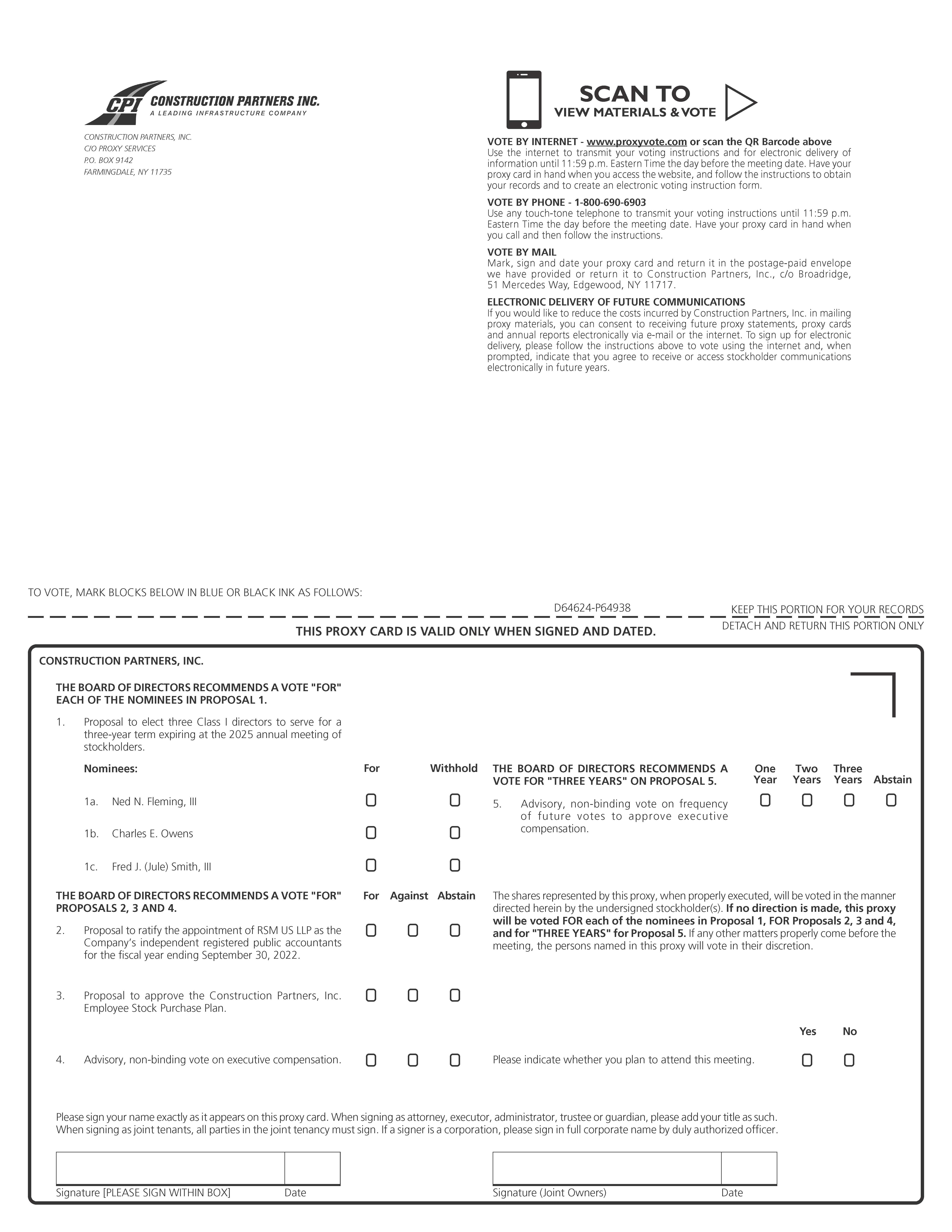

The following fivefour proposals are scheduled to be voted on at the Annual Meeting:

•Proposal 1: the election of three Class IIII directors to serve for a three-year term expiring at the 20252027 Annual Meeting of Stockholders

•Proposal 2: the ratification of the appointment of RSM US LLP (“RSM”) as the Company’s independent registered public accountantsaccountant for the fiscal year ending September 30, 20222024

•Proposal 3: the approval of the adoption of the Construction Partners, Inc. Employee2024 Restricted Stock Purchase Plan (the “ESPP”“Restricted Stock Plan”)

•Proposal 4: a non-binding, advisory vote on our executive compensation

•Proposal 5: a non-binding, advisory vote on the frequencyapproval of future advisory votes on our executive compensationan amendment to the Construction Partners, Inc. 2018 Equity Incentive Plan (the “Equity Incentive Plan”) to increase the number of shares reserved for issuance pursuant to awards

Who may vote at the Annual Meeting?

The Board has fixed January 3, 202222, 2024 as the record date (the “Record Date”) for determining stockholders of the Company entitled to receive notice of and vote at the Annual Meeting. Only stockholders of record as of the close of business on the Record Date are entitled to vote at the Annual Meeting. On the Record Date, there were (i) 41,084,30143,828,855 shares of Class A common stock, par value $0.001 (“Class A common stock”), issued and outstanding, held by 240303 stockholders of record, including 700,312 shares held by funds and entities controlled by SunTx, and (ii) 11,352,9158,998,511 shares of Class B common stock, par value $0.001 (“Class B common stock”), issued and outstanding, held by 2336 stockholders of record, including 8,594,247 shares held by funds and entities controlled by SunTx.record. The actual number of beneficial holders of our Class A common stock is significantly greater than the number of stockholders of record and includes stockholders who are beneficial owners, but whose shares are held by banks, brokers and other nominees.

What are my voting rights under the Company’s dual class equity structure?

On April 23, 2018, we amendedOur Amended and restated our certificateRestated Certificate of incorporation to effectuateIncorporation (the “Amended and Restated Certificate of Incorporation”) provides for a dual class common stock structure consisting of Class A and Class B common stock. This amendment and restatement resulted in the initial authorization of Class A common stock and the automatic conversion of each share of our common stock, par value $0.001 per share, into 25.2 shares of Class B common stock. In this Proxy Statement, we refer to these actions collectively as the “Reclassification,” and we refer to the Class A and Class B common stock collectively as the “common stock.”

The rights of holders of our Class A common stock and our Class B common stock are identical, except with respect to voting rights, conversion rights and certain transfer restrictions applicable to our Class B common stock. With respect to each proposal to come before the stockholders at the Annual Meeting, including the election of directors, each share of Class A common stock is entitled to one vote, and each share of Class B common stock is entitled to ten votes. As of the Record Date, there were (i) 41,084,30143,828,855 shares of Class A common stock outstanding, representing 78.3%83.0% of our total equity ownership and 26.6%32.8% of the total voting power of our outstanding common stock, and (ii) 11,352,9158,998,511 shares of Class B common stock outstanding, representing 21.7%17.0% of our total equity ownership and 73.4%67.2% of the total voting power of our outstanding common stock. As of the Record Date, funds and entities controlled bythe SunTx held 700,312Group beneficially owned 619,528 shares of Class A common stock and 8,594,2476,829,641 shares of Class B common stock, representing 51.5% of the total voting power of our outstanding common stock. As a result of this ownership structure, holders of our Class B common stock, and the SunTx Group in particular, have the ability to elect all of the members of our Board and to control the outcome of any other proposals to come before the stockholders at the Annual Meeting.

If I hold my shares through a brokerage firm, bank or other nominee, how do I vote at the Annual Meeting?

If your shares are held through a brokerage firm, bank or other nominee (collectively, “nominees”), then you are considered the beneficial owner of shares held in “street name,” and these proxy materials are being forwarded to you by your nominee, who is considered the stockholder of record with respect to those shares. As the beneficial owner, you are invited to attend the Annual Meeting. However, you may vote shares held in “street name” in person at the Annual Meeting only if you obtain a signed proxy from the record holder (your nominee) giving you the right to vote the shares. You also have the right to direct your nominee how to vote your shares. Your nominee should have enclosed a voting instruction form explaining the process for voting your shares.

What is a broker non-vote and how are broker non-votes treated?non-vote?

A “broker non-vote” occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee has not received instructions from the beneficial owner about how to vote on the proposal and does not have discretionary voting power for that proposal. If your shares are held in street name through a nominee and you do not instruct your nominee about how to vote your shares, then your nominee may vote your shares only on routine matters or, in its discretion, may leave your shares unvoted. Broker non-votes will be counted as present for purposes of establishing a quorum.

The ratification of RSM as our independent registered public accounting firm for our fiscal year ending September 30, 2022 (Proposal 2)2024 (“Proposal 2”) is the only routine matter to be presented at the Annual Meeting.Meeting, and as a result, brokers have discretionary authority to vote your shares of common stock with respect to such proposal. The other four matterselection of directors (“Proposal 1”), the approval of the adoption of the Restricted Stock Plan (“Proposal 3”) and the approval of an amendment to the Equity Incentive Plan to increase the number of shares reserved for issuance pursuant to awards (“Proposal 4”) are non-routine, and brokers will not be allowed to vote on these proposals without specific voting instructions from beneficial owners.

If I am a stockholder of record, how do I vote at the Annual Meeting?

If your shares are registered directly in your name with the Company’s transfer agent, Continental Stock Transfer & Trust Company, Inc. (“Continental”), then you are considered the stockholder of record with respect to those shares, and these proxy materials are being sent directly to you. As the stockholder of record, you may vote your shares in person at the Annual Meeting. If you choose to vote your shares in person at the Annual Meeting, please bring to the Annual Meeting proof of your identity and your ownership of the Company’s common stock on the Record Date, such as the enclosed proxy card or a statement of ownership from Continental. Even if you plan to attend the Annual Meeting, the Company recommends that you vote your shares in advance as described below so that your vote will be counted if you later decide not to, or are otherwise unable to, attend the Annual Meeting.

You also have the right to grant your voting proxy directly to the persons named as proxy holders, Ned N. Fleming, III, our Executive Chairman, Fred J. (Jule) Smith, III, our President and Chief Executive Officer, and R. Alan Palmer,Gregory A. Hoffman, our ExecutiveSenior Vice President and Chief Financial Officer, by any of the following means:

•By Internet: Go to the website www.proxyvote.com and follow the instructions. You will need the control number included on the enclosed proxy card in order to vote by internet.

•By Telephone: Dial toll-free 1-800-690-6903 and follow the recorded instructions. You will need the control number included on the enclosed proxy card in order to vote by telephone.

•By Mail: Mark your selections on the enclosed proxy card, date and sign your name exactly as it appears on the proxy card and mail the proxy card in the enclosed pre-paid envelope. Mailed proxy cards must be received no later than February 21, 2022March 19, 2024 in order to be counted at the Annual Meeting.

In accordance with the Company’s amendedAmended and restated by-laws,Restated By-laws (the “Amended and Restated By-laws”), a complete list of stockholders of record who are entitled to vote at the Annual Meeting will be available for inspection during the ten-day period prior toending on the day before the Annual Meeting at the main office of the Company during regular business hours and at the Annual Meeting.hours.

May I revoke my proxy or change my voting instructions?

You may revoke your proxy or change your voting instructions prior to the Annual Meeting. If your shares are held through a nominee, you must follow the instructions from your nominee on how to change or revoke your voting instructions or how to vote in person at the Annual Meeting. If you are a stockholder of record, you may enter new voting instructions by using the internet or telephone methods described above or by mailing a new proxy card bearing a later date. Any of these methods will automatically revoke your earlier voting instructions if they are received by 11:59 p.m., Central Time, on February 21, 2022.March 19, 2024. You may also enter a new vote by attending the Annual Meeting and voting in person. Your attendance at the Annual Meeting in person will not cause your previously granted proxy to be revoked unless you cast a new vote at the Annual Meeting.

What vote is required to approve each proposal, how are abstentions and broker non-votes treated and what are my choices when voting?

The election of directors will be determined by a plurality of the votes cast by the stockholders present in person or represented by proxy at the Annual Meeting and entitled to vote in the election of directors. Under a plurality voting standard, the directors who are elected to serve on our Board will be the three nominees receiving the highest number of votes cast in the election. For each nominee, stockholders may either vote “FOR”“FOR” that nominee or “WITHHOLD”“WITHHOLD” their vote with respect to that nominee. Accordingly, shares electing to “WITHHOLD”“WITHHOLD” from voting for a particular nominee and broker non-votes will be counted as present for purposes of establishing a quorum, but will have no effect on the election of directors.

EachApproval of the other proposalseach of Proposal 2, Proposal 3 and Proposal 4 requires for approval the affirmative vote of a majority of the votes cast by the stockholders present in person or represented by proxy at the Annual Meeting and entitled to vote on the applicable proposal.matter. Under this standard, a proposaleach of Proposal 2, Proposal 3 and Proposal 4 will be approved if the number of votes cast in favor of the proposal exceeds the number of votes cast against it. With respect to Proposals 2, 3 and 4, stockholders may either vote “FOR”“FOR” or “AGAINST”“AGAINST” the proposal or may “ABSTAIN” from voting on the proposal. With respect to Proposal 5, stockholders may vote to hold future advisory votes on executive compensation every “ONE YEAR,“ABSTAIN” “TWO YEARS” or “THREE YEARS” or may “ABSTAIN” from voting on the proposal. Shares abstaining from voting on the proposal and broker non-votes, if any,Proposal 2, 3 or 4 will be counted as present for purposes of establishing a quorum but will have no effect on the outcome of the vote.

Your votescommon stock with respect to the approval of the compensation of our named executive officers (Proposal 4) and the frequency of future advisory votessuch proposal. Broker non-votes will have no effect on executive compensation (Proposal 5) are advisory, which means the result of each such vote is non-binding on us, the Board and the committees of the Board. Although non-binding, the Board and its committees value the opinions of our stockholders and will review and consider the voting results when making future decisions regarding executive compensation.Proposal 3 or Proposal 4.

The holders of our common stock do not have cumulative voting rights with respect to the matters to be acted on at the Annual Meeting. Therefore, stockholders holding a majority in voting power of the shares of our common stock entitled to vote generally in the election of directors will be able to elect all of our directors.

Why am I being asked to approve the ESPP?

What is the Board’s voting recommendation for the proposals?

The Board recommends that you vote your shares “FOR” each of the nominees to the Board for Proposal 1 and “FOR” the approval of Proposals 2, 3 and 4, and “THREE YEARS” with respect to Proposal 5.4. If you are a record holder who returns a completed proxy card that does not specify how you want to vote your shares on the proposals, your shares will be voted in accordance with the Board recommendations described above. The Board urges you to review these proxy materials carefully before you vote.

Where can I find the voting results of the Annual Meeting?

We will announce preliminary voting results at the Annual Meeting and publish preliminary results, or final results if available, in a Current Report on Form 8-K within four business days after the Annual Meeting. If final results are unavailable at the time at which we file the Form 8-K, then we will file an amended report on Form 8-K to disclose the final voting results within four business days after the final voting results are known.

What happens if additional proposals are presented at the Annual Meeting?

Other than the proposals described in this Proxy Statement, we do not expect any matters to be presented for a vote at the Annual Meeting. If you grant a proxy, the persons named as proxy holders, Ned N. Fleming, III, our Executive Chairman, Fred J. (Jule) Smith, III, our President and Chief Executive Officer, and R. Alan Palmer,Gregory A. Hoffman, our ExecutiveSenior Vice President and Chief Financial Officer, will have the discretion to vote your shares on any additional matters properly presented for a vote at the Annual Meeting. If, for any reason, one or more of the Company’s nominees is not available as a candidate for director, then the persons named as proxy holders will vote your proxyshares for which completed proxies are returned for such other candidate or candidates as may be nominated by the Board.

What is the quorum requirement for the Annual Meeting?

The presence in person or by proxy of the holders of shares representing a majority of the voting power of all outstanding shares of the Company’s common stock entitled to vote at the Annual Meeting will constitute a quorum at the Annual Meeting. Abstentions and broker non-votes are counted as present for the purpose of determining the presence of a quorum, but will have no effect on the outcome of the vote on the proposals to be presented at the Annual Meeting.quorum.

Who will count the vote?

We have engaged Broadridge Financial Solutions, Inc. to tabulate the votes represented by proxies from brokerage firms, banks and other nominees and stockholders of record. A representative of the Company will act as the inspector of election.

Is my vote confidential?

Proxy instructions, ballots and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within the Company or to third parties, except (i) as

necessary to meet applicable legal requirements, (ii) to allow for the tabulation and certification of the votes and (iii) to facilitate a successful proxy solicitation by the Board.

Do I have any dissenters’ or appraisal rights with respect to any of the matters to be voted on at the Annual Meeting?

No. None of our stockholders have any dissenters’ or appraisal rights with respect to the matters to be voted on at the Annual Meeting.

May I propose actions for consideration at next year’s Annual Meeting of Stockholders or nominate individuals to serve as directors?

You may submit proposals and director nominations for consideration at future Annual Meetings of Stockholders as follows:

Stockholder Proposals under Rule 14a-8: In order for a proposal by a stockholder of the Company to be eligible to be included in the Company’s proxy statement for the 20232025 Annual Meeting of Stockholders pursuant to the proposal process mandated by Rule 14a-8 (“Rule 14a-8”) under the Securities Exchange Act (“Rule 14a-8”of 1934, as amended (the “Exchange Act”), the proposal generally must be received by the Company on or before September 14, 202228, 2024 and must comply with the informational and other requirements set forth in Regulation 14A under the Exchange Act.

Inclusion of Stockholder Director Candidates on Company Proxy Card: Stockholders who intend to solicit proxies in support of director nominees other than our nominees must provide notice to our Secretary that sets forth the information required by Rule 14a-19 of the Exchange Act in accordance with and within the time period prescribed in the advance notice provisions of our Amended and Restated By-laws.

Other Stockholder Proposals and Nomination of Director Candidates: The Company’s amendedAmended and restated by-lawsRestated By-laws also permit stockholders to nominate directors or submit proposals for a vote at a meeting of stockholders outside of the process provided by Rule 14a-8. In order for a stockholder to raise a proposal from the floor at an Annual Meeting of Stockholders or nominate an individual for election as a director, the proposal or nomination generally must be received by the Company not more than 120 days or less than 90 days before the first anniversary of the date of the preceding year’s Annual Meeting of Stockholders. Thus, in order for a proposal or nomination to be timely for the 20232025 Annual Meeting of Stockholders, the proposal, together with the information required under the applicable by-law provision, generally must be received by the Company not earlier than October 25, 2022November 20, 2024 or later than November 24, 2022. December 20, 2024.

Copy of Amended and Restated By-LawBy-law Provisions: Our amendedAmended and restated by-lawsRestated By-laws are available on the SEC’s website at http://www.sec.gov. You may also contact our Secretary at our corporate headquarters for a copy of the relevant provisions of our amendedAmended and restated by-lawsRestated By-laws regarding the requirements for making stockholder proposals and nominating director candidates. Additionally, a copy of our amendedAmended and restated by-lawsRestated By-laws is available on our website at www.constructionpartners.net under the “Investors - Governance” tab.

For additional information about the deadlines for stockholder proposals and nominations for director candidates, see the discussion below under the heading “Deadline for Stockholder Proposals.”

What does it mean if I receive more than one set of proxy materials?

If you received more than one set of proxy materials, then your shares are registered in different names or are in more than one account. For each set of proxy materials that you receive, please submit your vote for the control number that has been assigned to you in such materials.

How do I obtain a separate set of proxy materials if I share an address with other stockholders?

To reduce expenses, in some cases, we may deliver one set of proxy materials to certain stockholders who share an address, unless otherwise requested by one or more of the stockholders. However, in such situations, a separate proxy card has been included with the proxy materials for each stockholder. If you have received only one set of proxy materials, you may request separate copies to be delivered promptly at no additional cost to you by calling us at (334) 673-9763 or by writing to us at Construction Partners, Inc., 290 Healthwest Drive, Suite 2, Dothan, Alabama 36303, Attention: Secretary. We hereby undertake to deliver promptly, upon written or oral request, a copy of the proxy materials to a stockholder at a shared address to which a single set of proxy materials was delivered.

If I share an address with other stockholders of the Company, how can we receive only one set of proxy materials for future meetings?

You may request that we send you and the other stockholders who share an address with you only one set of proxy materials by calling us at (334) 673-9763 or by writing to us at Construction Partners, Inc., 290 Healthwest Drive, Suite 2, Dothan, Alabama 36303, Attention: Secretary.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the beneficial ownership of our common stock as of the Record Date by: (i) each of our directors, including each director nominee; (ii) each of our named executive officers (our “NEOs”); (iii) all of our current directors and executive officers as a group; and (iv) each stockholder known by the Company to beneficially own more than 5% of a class of our common stock. Beneficial ownership is determined in accordance with the rules of the SEC and includes voting or investment power with respect to the securities. Shares of common stock that an individual or group has the right to acquire within 60 days of the Record Date, including through the exercise of derivative securities, such as options, are deemed to be beneficially owned by such individual or group and are deemed to be outstanding for the purpose of computing the percentage ownership of such individual or group, but are not deemed to be outstanding for the purpose of computing the percentage ownership of any other person shown in the table.

The applicable percentage of ownership is based on a total of 41,084,30143,828,855 shares of Class A common stock and 11,352,9158,998,511 shares of Class B common stock outstanding as of the Record Date. Each share of Class A common stock is entitled to one vote per share, and each share of Class B common stock is entitled to ten votes per share. The Class A common stock and Class B common stock vote together on all matters submitted to a vote of stockholders, unless otherwise required by applicable law, our amendedAmended and restated certificateRestated Certificate of incorporationIncorporation or our amendedAmended and restated by-laws.Restated By-laws. Neither class of our common stock has cumulative voting rights. Except as indicated in the footnotes below, we believe, based on information furnished to us, that the persons and entities named in the table below have sole voting and investment power with respect to all shares of our common stock that they beneficially own. The Company does not know of any arrangements, including any pledge by any person of the Company’s securities, the operation of which may at a subsequent date result in a change in control of the Company. Unless otherwise indicated, the address for each director and NEO is: c/o Construction Partners, Inc., 290 Healthwest Drive, Suite 2, Dothan, Alabama 36303.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Common Stock Beneficially Owned | | | |

| | Class A | | Class B | | | |

| Name of Beneficial Holder | | Shares | | % of Class | | Shares | | % of Class | | % of Total Voting Power † |

| 5% STOCKHOLDERS | | | | | | | | | | | | | |

SunTx Fulcrum Fund Prime, L.P. (1) (8) (9) (11) | | 37,248 | | | * | | | 1,788,520 | | | 15.8 | | % | | 11.6 | | % |

SunTx Fulcrum Dutch Investors Prime, L.P. (2) (8) (9) (11) | | — | | | * | | | 677,629 | | | 6.0 | | % | | 4.4 | | % |

SunTx Capital Partners, L.P. (3) (9) (11) | | — | | | * | | | 2,399,999 | | | 21.1 | | % | | 15.5 | | % |

SunTx Capital Partners II, L.P. (4) (10) (11) | | 428,817 | | | 1.0 | | % | | 2,496,267 | | | 22.0 | | % | | 16.4 | | % |

SunTx Capital Partners II Dutch Investors, L.P. (5) (10) (11) | | 234,247 | | | * | | | 1,228,463 | | | 10.8 | | % | | 8.1 | | % |

SunTx Capital Management Corp. (6) (11) | | — | | | * | | | 2,695 | | | * | | | * | |

SunTx Capital II Management Corp. (7) (11) | | — | | | * | | | 674 | | | * | | | * | |

Grace, Ltd. (12) | | — | | | — | | | | 1,250,000 | | | 11.0 | | % | | 8.1 | | % |

Conestoga Capital Advisors, LLC (13) | | 5,144,652 | | | 12.5 | | % | | — | | | — | | | | 3.3 | | % |

Wasatch Advisors, Inc. (14) | | 3,599,484 | | | 8.8 | | % | | — | | | — | | | | 2.3 | | % |

Kayne Anderson Rudnick Investment Management LLC (15) | | 2,521,127 | | | 6.1 | | % | | — | | | — | | | | 1.6 | | % |

| | | | | | | | | | | | | |

| DIRECTORS | | | | | | | | | | | | | |

Ned N. Fleming, III (16) (17) | | 840,137 | | | 2.0 | | % | | 9,032,866 | | | 79.6 | | % | | 59.0 | | % |

Craig Jennings (16) (18) | | 738,504 | | | 1.8 | | % | | 8,686,346 | | | 76.5 | | % | | 56.7 | | % |

Mark R. Matteson (16) (19) | | 739,504 | | | 1.8 | | % | | 8,740,039 | | | 77.0 | | % | | 57.0 | | % |

| Michael H. McKay | | 41,291 | | | * | | | 35,406 | | | * | | | * | |

Charles E. Owens (20) | | — | | | — | | | | 1,252,695 | | | 11.0 | | % | | 8.1 | | % |

| Stefan L. Shaffer | | 38,192 | | | * | | | — | | | — | | | | * | |

| Noreen E. Skelly | | 25,191 | | | * | | | — | | | — | | | | * | |

Fred J. (Jule) Smith, III (21) | | 124,498 | | | * | | | 426,523 | | | 3.8 | | % | | 2.8 | | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Common Stock Beneficially Owned | | | |

| | Class A | | Class B | | | |

| Name of Beneficial Holder | | Shares | | % of Class | | Shares | | % of Class | | % of Total Voting Power † |

| 5% STOCKHOLDERS | | | | | | | | | | | | | |

SunTx Capital II Management Corp. (1) (2) | | 397,991 | | | * | | | 4,197,876 | | | 46.7 | | % | | 31.7 | | % |

Grace, Ltd. (3) | | — | | | * | | | 1,250,000 | | | 13.9 | | % | | 9.3 | | % |

Conestoga Capital Advisors, LLC (4) | | 4,798,691 | | | 10.9 | | % | | — | | | * | | | 3.6 | | % |

Geneva Capital Management LLC (5) | | 2,714,052 | | | 6.2 | | % | | — | | | * | | | 2.0 | | % |

Kayne Anderson Rudnick Investment Management LLC (6) | | 4,310,440 | | | 9.8 | | % | | — | | | * | | | 3.2 | | % |

Blackrock, Inc. (7) | | 2,978,459 | | | 6.8 | % | | — | | | * | | | 2.2 | % |

Invesco Ltd. (8) | | 2,191,966 | | | 5.0 | % | | — | | | * | | | 1.6 | % |

| | | | | | | | | | | | | |

| DIRECTORS | | | | | | | | | | | | | |

Ned N. Fleming, III (9) (10) | | 559,066 | | | 1.3 | | % | | 5,949,748 | | | 66.1 | | % | | 44.9 | | % |

Craig Jennings (9) (11) | | 427,722 | | | * | | | 4,549,054 | | | 50.6 | | % | | 34.3 | | % |

Mark R. Matteson (9) (12) | | 428,722 | | | * | | | 4,726,591 | | | 52.5 | | % | | 35.6 | | % |

Michael H. McKay (13) | | 52,624 | | | * | | | 40,098 | | | * | | | * | |

Charles E. Owens (14) | | — | | | * | | | 1,256,775 | | | 14.0 | | % | | 9.4 | | % |

Stefan L. Shaffer (15) | | 34,495 | | | * | | | — | | | * | | | * | |

Noreen E. Skelly (16) | | 22,934 | | | * | | | — | | | * | | | * | |

Fred J. (Jule) Smith, III (17) | | 147,725 | | | * | | | 476,523 | | | 5.3 | | % | | 3.7 | | % |

| | | | | | | | | | | | | |

| NON-DIRECTOR NEOS | | | | | | | | | | | | | |

M. Brett Armstrong (18) | | 60,693 | | | * | | | 20,160 | | | * | | | * | |

Robert P. Flowers (19) | | 70,225 | | | * | | | 5,990 | | | * | | | * | |

John L. Harper (20) | | 180,106 | | | * | | | — | | | * | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Common Stock Beneficially Owned | | | |

| | Class A | | Class B | | | |

| Name of Beneficial Holder | | Shares | | % of Class | | Shares | | % of Class | | % of Total Voting Power † |

| | | | | | | | | | | | | |

| NON-DIRECTOR NEOS | | | | | | | | | | | | | |

M. Brett Armstrong (22) | | 48,200 | | | * | | | 20,160 | | | * | % | | * | |

Robert P. Flowers (23) | | 58,825 | | | * | | | 5,990 | | | * | % | | * | |

John L. Harper (24) | | 250,578 | | | * | | | — | | | — | | | | * | |

R. Alan Palmer (25) | | 31,500 | | | * | | | 130,209 | | | 1.1 | | % | | * | |

| | | | | | | | | | | | | |

| All Directors and Executive Officers as a Group (15 persons) | | 1,624,841 | | | 4.0 | | % | | 11,141,740 | | | 98.1 | | % | | 73.1 | | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Common Stock Beneficially Owned | | | |

| | Class A | | Class B | | | |

| Name of Beneficial Holder | | Shares | | % of Class | | Shares | | % of Class | | % of Total Voting Power † |

Gregory A. Hoffman (21) | | 47,245 | | | * | | | — | | | * | | | * | |

R. Alan Palmer (22) | | 26,793 | | | * | | | 80,209 | | | * | | | * | |

| | | | | | | | | | | | | |

| All Current Directors and Executive Officers as a Group (14 persons) | | 1,305,288 | | | 3.0 | | % | | 8,629,187 | | | 95.9 | | % | | 65.5 | | % |

| | | | | |

| * | Represents less than 1%. |

| † | Represents the voting power with respect to all shares of Class A common stock and Class B common stock outstanding as of the Record Date, voting as a single class. |

| (1) | Shares are held directly by SunTx Fulcrum Fund Prime, L.P. (“SunTx Fulcrum Fund”). |

(2) | Shares are held directly by SunTx Fulcrum Dutch Investors Prime, L.P. (“SunTx Fulcrum Dutch Fund”). |

(3) | Shares are held directly by SunTx Capital Partners L.P. (“SunTx Partners”). |

(4) | Shares areConsists of (a) 234,930 shares of Class A common stock and 2,585,096 shares of Class B common stock held directly by SunTx Capital Partners II, L.P. (“SunTx Partners II”). |

(5) | Shares are, (b) 128,134 shares of Class A common stock and 1,294,908 shares of Class B common stock held directly by SunTx Capital Partners II Dutch Investors, L.P. (“SunTx Partners II Dutch”). |

(6) | Shares are held directly by SunTx Capital Management Corp. (“SunTx Capital Management”). |

(7) | Shares are, (c) 674 shares of Class B common stock held directly by SunTx Capital II Management Corp. (“SunTx Capital II Management”). |

(8) | The general partner, (d) 34,927 shares of Class A common stock and 76,190 shares of Class B common stock held directly by N. Nelson Fleming, IV and (e) 241,008 shares of Class B common stock held directly by the Ned N. Fleming, IV 2013 Trust. SunTx Fulcrum Fund and SunTx Fulcrum Dutch Fund is SunTx Partners. |

(9) | The general partner of Capital Partners II GP, LP (“SunTx Partners II GP”) is SunTx Capital Management. |

(10) | Thethe general partner of SunTx Partners II and SunTx Partners II Dutch isDutch. SunTx Capital Partners II GP, LP (“SunTx Partners II GP”). TheManagement is the general partner of SunTx Partners II GP. Each of SunTx Partners II GP isand SunTx Capital II Management.Management may be deemed to beneficially own securities of the Company held by SunTx Partners II and SunTx Partners II Dutch. Each such entity disclaims beneficial ownership of such securities except to the extent of its pecuniary interest therein. SunTx Capital Management Corp., SunTx Capital II Management, N. Nelson Fleming, IV and the Ned N. Fleming, IV 2013 Trust are parties to a voting agreement, pursuant to which N. Nelson Fleming, IV and the Ned N. Fleming, IV 2013 Trust agreed to vote their shares of common stock in favor of SunTx Capital Management Corp. and SunTx Capital II Management’s recommended candidates for service on the Board. As a result, SunTx Capital Management II has shared voting power over the shares held directly by N. Nelson Fleming, IV and the Ned N. Fleming, IV 2013 Trust. The business address of SunTx Capital II Management is c/o SunTx Capital Management Corp., 5420 LBJ Freeway, Suite 1000, Dallas, Texas 75240. |

(11)(2) | Ned N. Fleming, III, Executive Chairman of our Board, is the sole shareholder and director of SunTx Capital Management and is the majority shareholder and sole director of SunTx Capital II Management. Craig Jennings and Mark R. Matteson, each a director of the Company, are executive officers of SunTx Capital Management and shareholders of SunTx Capital II Management. Each of SunTx Partners, SunTx Capital Management, SunTx Partners II GP, SunTx Capital II Management, Mr. Fleming, Mr. Jennings and Mr. Matteson may be deemed to beneficially own securities of the Company held by SunTx Fulcrum Fund, SunTx Fulcrum Dutch Fund,Partners II, SunTx Partners II Dutch and SunTx Partners Dutch LPCapital II Management (collectively, the “SunTx Funds”Entities”). Each such entity and person disclaims beneficial ownership of such securities except to the extent of its or his pecuniary interest therein. The business address of each of the foregoing persons and entities, as well as the SunTx Funds, is c/o SunTx Capital Management Corp., 5420 LBJ Freeway, Suite 1000, Dallas, Texas 75240. |

(12)(3) | Charles E. Owens, the Vice Chairman of our Board, is the general partner of Grace, Ltd. As the general partner of Grace, Ltd., Mr. Owens may be deemed to beneficially own shares held by Grace, Ltd. Mr. Owens disclaims beneficial ownership of such securities except to the extent of his pecuniary interest therein. The business address of Grace, Ltd. is 10 Chateau Place, Dothan, Alabama 36303. |

(13)(4) | Beneficial ownership information is as of December 31, 2020,2023, as reported on a Schedule 13G/A filed by Conestoga Capital Advisors, LLC (“Conestoga”) on January 6, 2021.5, 2024. As reported on the Schedule 13G/A, Conestoga beneficially owned a total of 5,144,6524,798,691 shares of Class A common stock as of the report date, including 2,885,8012,644,907 shares in the Conestoga Small Cap Fund. Of the reported shares, Conestoga had sole voting power over 4,908,6034,540,482 shares and sole dispositive power over 5,144,6524,798,691 shares. The address of the business office of Conestoga is 550 East Swedesford Road, Suite 120, Wayne, Pennsylvania 19087. |

| | | | | |

(14)(5) | Beneficial ownership information is as of MarchDecember 31, 2021,2022, as reported on a Schedule 13G/A filed by Wasatch Advisors, Inc.Geneva Capital Management LLC (“Wasatch”Geneva Capital Management”) on April 9, 2021.February 10, 2023. As reported on the Schedule 13G/A, WasatchGeneva Capital Management beneficially owned a total of 3,599,4842,714,052 shares of Class A common stock as of the report date. WasatchOf the reported shares, Geneva Capital Management held soleshared voting power over 2,672,459 shares and shared dispositive power over all shares that it beneficially owned as of such date.2,714,052 shares. The address of the business office of WasatchGeneva Capital Management is 505 Wakara Way, Salt Lake City, Utah 84108.411 East Wisconsin Avenue, Suite 2320, Milwaukee, Wisconsin 53202. |

(15)(6) | Beneficial ownership information is as of December 31, 2020,2022, as reported on a Schedule 13G13G/A filed by Kayne Anderson Rudnick Investment Management LLC (“Kayne Anderson”) on February 11, 2021.14, 2023. As reported on the Schedule 13G,13G/A, Kayne Anderson beneficially owned a total of 2,521,1274,310,440 shares of Class A common stock as of the report date. Of the reported shares, Kayne Anderson held sole voting andpower over 2,573,385 shares, sole dispositive power over 1,732,8923,191,110 shares, and shared voting and dispositive power over 788,2351,119,330 shares. The address of the business office of Kayne Anderson is 18002000 Avenue of the Stars, 2nd Floor,Suite 1110, Los Angeles, California 90067. |

(16)(7) | Beneficial ownership information is as of December 31, 2022, as reported on a Schedule 13G/A filed by Blackrock, Inc. (“Blackrock”) on January 31, 2023. As reported on the Schedule 13G/A, Blackrock beneficially owned a total of 2,978,459 shares of Class A common stock as of the report date. Of the reported shares, Blackrock held sole voting power over 2,931,167 shares and sole dispositive power over 2,978,459 shares. The address of the business office of Blackrock is 55 East 52nd Street, New York, New York 10055. |

| (8) | Beneficial ownership information is as of December 31, 2022, as reported on a Schedule 13G filed by Invesco Ltd. (“Invesco”) on February 10, 2023. As reported on the Schedule 13G/A, Invesco beneficially owned a total of 2,191,966 shares of Class A common stock as of the report date. Of the reported shares, Invesco held sole voting power over 2,091,675 shares and sole dispositive power over 2,191,966 shares. The address of the business office of Invesco is 1555 Peachtree Street NE, Suite 1800, Atlanta, Georgia 30309. |

| (9) | Includes shares of Class A and Class B common stock held by the SunTx FundsEntities, N. Nelson Fleming, IV and related entities.the Ned N. Fleming, IV 2013 Trust. SunTx Capital Management II has shared voting power over the shares held directly by N. Nelson Fleming, IV and the Ned N. Fleming, IV 2013 Trust. See footnote 11footnotes 1 and 2 above. |

(17)(10) | IncludesAlso includes (a) 4,000 shares of Class A sharescommon stock owned by Mr. Fleming’s spouse, (b) 272 shares of Class B sharescommon stock held by Boyle Fleming & Co, Inc., a corporation for which Mr. Fleming serves as an executive officer and, in such capacity, holds the power to vote and direct the disposition of the shares, (c) 438,3471,740,472 shares of Class B sharescommon stock held by Malachi Holdings, L.P., a limited partnership for which Mr. Fleming serves as general partner and, in such capacity, holds the power to vote and direct the disposition of the shares, (d) 8,433 shares of Class B common stock held by the SunTx Capital Savings Plan FBO Ned N. Fleming, III, over which shares Mr. Fleming holds the power to vote and (d) 21,250direct the disposition, and (e) 14,168 restricted shares of Class A sharescommon stock that will vest as to two-thirds of the award on January 1, 2024 and as to the remaining one-third of the award on January 1, 2025. |

(18)(11) | Includes 92,099Also includes (a) 351,178 shares of Class B sharescommon stock held by CJCT Associates, L.P. (“CJCT”), a limited partnership for which Mr. Jennings serves as general partner and, in such capacity, holds the power to vote and direct the disposition of the shares.shares and (b) 5,667 restricted shares of Class A common stock that will vest on January 1, 2025. |

(19)(12) | Includes 145,792Also includes (a) 528,715 shares of Class B sharescommon stock held by AMDG Associates, L.P. (“AMDG”), a limited partnership for which Mr. Matteson serves as general partner and, in such capacity, holds the power to vote and direct the disposition of the shares.shares and (b) 5,667 restricted shares of Class A common stock that will vest on January 1, 2025. |

(20)(13) | Includes (a) 40,098 shares of Class B common stock held by the Michael H. McKay Trust., a revocable trust for which Mr. McKay serves as sole trustee and, in such capacity, holds the power to vote and direct the disposition of the shares and (b) 5,667 restricted shares of Class A common stock that will vest on January 1, 2025. |

| (14) | Includes 1,250,000 shares of Class B sharescommon stock held by Grace, Ltd. See footnote 123 above. |

(21)(15) | Includes 5,667 restricted shares of Class A common stock that will vest on January 1, 2025. |

| (16) | Includes (a) 5,934 shares of Class A common stock held by the Skelly Revocable Trust, a revocable trust for which Ms. Skelly serves as co-trustee, and, in such capacity, shares the power to vote and direct the disposition of such shares, and (b) 5,667 restricted shares of Class A common stock that will vest on January 1, 2025. |

| | | | | |

| (17) | Includes 134,582 shares of Class B common stock held by Tar Frog Investment Management, LLC, a limited liability company for which Mr. Smith serves as co-manager, and, in such capacity, shares the power to vote and direct the disposition of the shares. Also includes 120,666119,382 restricted shares of Class A sharescommon stock that vested or will vest as applicable, as follows: (a) 7,50057,708 shares that vest in one-third increments on January 4, 2022, 2023 and 2024, (b) 5,500 shares that vest in one-third increments on September 30, 2022, 2023 and 2024, (c) 7,666 shares that vest in one-fourth increments on September 30, 2022, 2023, 2024 and 2025, and (d) 100,000 shares that vest in one-half increments on September 30, 2024, (b) 55,876 shares on September 30, 2025 (c) 3,960 shares on September 30, 2026 and 2025.(d) 1,838 shares on September 30, 2027. As of the Record Date, Mr. Smith had pledged a total341,941 shares of 3,832 Class A shares and 291,941 Class B sharescommon stock as security for personal financial arrangements. These pledges were approved by the Company in advance pursuant to the Company’s policy governing such arrangements. |

(22)(18) | Includes 46,85050,118 restricted shares of Class A sharescommon stock that vest as follows: (a) 2,85024,032 shares that vest in one-third increments on September 30, 2022, 2023 and 2024, (b) 4,000 shares that vest in one-fourth increments on September 30, 2022, 2023, 2024 and 2025, and (c) 40,000 shares that vest in one-half increments on September 30, 2024, (b) 23,082 shares on September 30, 2025, (c) 2,085 shares on September 30, 2026 and 2025.(d) 919 shares on September 30, 2027. |

(23)(19) | Includes 57,56058,702 restricted shares of Class A sharescommon stock that vest as follows: (a) 3,15028,814 shares that vest in one-third increments on September 30, 2022, 2023 and 2024, (b) 4,410 shares that vest in one-fourth increments on September 30, 2022, 2023, 2024 and 2025, and (c) 50,000 shares that vest in one-half increments on September 30, 2024, (b) 27,766 shares on September 30, 2025, (c) 1,664 shares on September 30, 2026 and 2025.(d) 460 shares on September 30, 2027. |

(24)(20) | Includes 500(a) 1,000 shares owned by Mr. Harper’s spouse.spouse, (b) 15,000 shares held by the Frances Harper Trust, for which Mr. Harper serves as sole trustee, and in such capacity holds the sole power to vote and direct the disposition of such shares, and (c) 15,000 shares held by the Harper Family Trust, for which Mr. Harper serves as co-trustee, and in such capacity shares the power to vote and direct the disposition of such shares. Also includes 57,83360,850 restricted shares of Class A sharescommon stock that vest as follows: (a) 3,26329,413 shares that vest in one-third increments on September 30, 2022, 2023 and 2024, (b) 4,570 shares that vest in one-fourth increments on September 30, 2022, 2023, 2024 and 2025, and (c) 50,000 shares that vest in one-half increments on September 30, 2024, (b) 28,326 shares on September 30, 2025, (c) 2,183 shares on September 30, 2026 and 2025.(d) 928 shares on September 30, 2027. As of the Record Date, Mr. Harper had pledged a total of 192,15577,000 shares of Class A sharescommon stock as security for personal financial arrangements. This pledge was approved by the Company in advance pursuant to the Company’s policy governing such arrangements. |

(25)(21) | Includes 39,464 restricted shares of Class A common stock that vest as follows: (a) 18,541 shares on September 30, 2024, (b) 17,793 shares on September 30, 2025, (c) 2,005 shares on September 30, 2026 and (d) 1,125 shares on September 30, 2027. |

| (22) | Includes 20,000 restricted shares of Class A sharescommon stock that vest in one-half incrementsas follows: (a) 10,000 shares on September 30, 2024 and 10,000 shares on September 30, 2025. Mr. Palmer retired as Executive Vice President and Chief Financial Officer of the Company on March 31, 2023, and although Mr. Palmer remains an employee of the Company, he ceased to be an executive officer of the Company on that date. The reported number of shares are determined on the basis of the Company’s internal records and information provided by Mr. Palmer. |

MANAGEMENT AND CORPORATE GOVERNANCE

Our Board of Directors

Our amendedAmended and restated certificateRestated Certificate of incorporationIncorporation provides that the number of members of the Board will be determined from time to time by resolution of the Board. Currently, the Board consists of eight members. The Board is divided into three classes, with Classes I and III consisting of three directors each and Class II consisting of two directors. The directors in each class serve three-year terms, with one class elected each year.

Our current directors are divided into the following classes:

•Class I, consisting of Ned N. Fleming, III, Charles E. Owens and Fred J. (Jule) Smith, III, whose terms will expire at the 2025 Annual Meeting;Meeting of Stockholders;

•Class II, consisting of Craig Jennings and Mark R. Matteson, whose terms will expire at the 20232026 Annual Meeting of Stockholders; and

•Class III, consisting of Michael H. McKay, Stefan L. Shaffer and Noreen E. Skelly, whose terms will expire at the 2024 Annual Meeting of Stockholders.Meeting.

Information about the Nominees and Other Directors

Set forth below are the biographies of each of the nominees and our other directors, including their names, ages, the committees of the Board on which they serve, positions and offices inheld with the Company, if any, principal occupations or employment for at least the past five years, the length of their tenure as directors, and the names of other public companies in which such persons hold or have held directorships during the past five years. Additionally, information about the specific experience, qualifications, attributes or skills that led to the Board’s conclusion that each person listed below should serve as a director is set forth below. The stock ownership of each director is set forth in the table above entitled “Security Ownership of Certain Beneficial Owners and Management.”

| | | | | | | | | | | | | | | | | |

| Name | | Age | | Position |

Ned N. Fleming, III (2) (3) | | 6163 | | Executive Chairman of the Board |

Craig Jennings | | 63 | | Director |

Craig Jennings (3) | | 65 | | Director |

Mark R. Matteson (2) (3) | | 5860 | | Director |

Michael H. McKay (1) | | 6062 | | Director |

Charles E. Owens (3) | | 7173 | | Vice Chairman of the Board |

Stefan L. Shaffer (1) (2) | | 6466 | | Director |

Noreen E. Skelly (1) | | 5759 | | Director |

| Fred J. (Jule) Smith, III | | 5254 | | President, Chief Executive Officer and Director |

| | | | | |

| (1) | Member of the Audit Committee |

| (2) | Member of the Compensation Committee |

| (3) | Member of the Nominating and Corporate Governance Committee |

Class IIII Nominees - Terms Expire at the Annual Meeting

Ned N. Fleming, III is one of the founders of our Company and has served as Executive Chairman of the Board since our inception. He has served as Managing Partner of SunTx since 2001 and also serves as chairman of the board of directors of Big Outdoor LLC. Mr. Fleming previously served as a member of the board of directors of Veritex Holdings, Inc., a publicly traded bank holding company, DF&R Restaurants, Inc., a formerly publicly traded restaurant operator, and Spinnaker Industries, Inc., a publicly traded material manufacturing company. Prior to co-founding SunTx in 2001, Mr. Fleming served as President and Chief Operating Officer of Spinnaker Industries, Inc. until its sale in 1999. Prior to that, Mr. Fleming worked at a Dallas-based private investment firm, where he led acquisitions in the food and beverage and defense industries. Mr. Fleming received a Master of Business Administration with distinction from Harvard Business School and a Bachelor of Arts in Political Science from Stanford University. As a result of his role with our Company since our inception, Mr. Fleming has significant knowledge of us and our industry, which we believe makes him well-qualified to serve as a director of our Company.

Charles E. Owens is one of the founders of our Company and served as our President and Chief Executive Officer and as a member of our Board from our inception until March 2021, when he transitioned to the role of Vice Chairman of our Board. From 1990 until its sale in 1999, Mr. Owens was President and Chief Executive Officer of Superfos Construction U.S., Inc. (“Superfos”), the North American operation of Superfos a/s, a publicly held Danish company. During his tenure at Superfos, he oversaw the successful acquisition and integration of approximately 35 companies, leading Superfos to become one of the largest highway construction companies in the United States. Prior to 1990, Mr. Owens was President of Couch Construction, Inc., a subsidiary of Superfos headquartered in Dothan, Alabama. Mr. Owens received a Bachelor of Business Administration from Troy University. As a result of his role with our Company since our inception, Mr. Owens has significant knowledge of us and our industry, which we believe makes him well-qualified to serve as a director of our Company.

Fred J. (Jule) Smith, III has served as our President and Chief Executive Officer since April 2021 and as a member of our Board since November 2021. Before that, Mr. Smith served as our Chief Operating Officer from October 2020 to March 2021 and as a Senior Vice President of the Company since 2017. Until October 2020, Mr. Smith also served in various management roles for FSC II, LLC, our North Carolina subsidiary (“FSC”), since 2005, including as its President from 2009 to 2020. Before joining FSC, Mr. Smith served as Chief Operating Officer of Fred Smith Construction, Inc. from 2005 to 2009. Prior to that, he held various other positions within Fred Smith Construction, Inc. and also served in the supply corps of the U.S. Navy. Mr. Smith received a Master of Business Administration and a Bachelor of Arts in History from Wake Forest University. We believe that Mr. Smith’s extensive experience in our industry and tenure as a key officer of our Company make him well-qualified to serve as a director of our Company.

Class II Continuing Directors - Terms Expire in 2023

Craig Jennings has served as a member of the Board since 2017. Since 2001, he has been a partner and Chief Financial Officer of SunTx. Prior to co-founding SunTx, Mr. Jennings was Vice President of Finance and Treasurer of Spinnaker Industries, Inc., a publicly traded materials manufacturing company, until its sale in 1999. Prior to that, Mr. Jennings held senior finance positions at a publicly traded oil field services company and a publicly traded food and beverage company, and also was a Senior Audit Manager with Ernst & Young LLP. Mr. Jennings received his Bachelor of Business Administration from the University of Toledo and is a Certified Public Accountant. We believe that Mr. Jennings’ investment, financial and directorship experience makes him well-qualified to serve as a director of our Company.

Mark R. Matteson has served as a member of the Board since our inception. Since 2001, he has been a partner of SunTx. Prior to co-founding SunTx in 2001, Mr. Matteson was Vice President of Corporate Development of Spinnaker Industries, Inc., a publicly traded materials manufacturing company, until its sale in 1999. He currently serves as chairman of the board of directors of Freedom Truck Finance, LLC and as a member of the board of directors of Anchor Partners, LLC. Mr. Matteson received a Master of Business Administration from Georgetown University and a Bachelor of Arts in Foreign Service and International Politics from The Pennsylvania State University. As a result of his role with our Company since our inception, Mr. Matteson has significant knowledge of us and our industry, which we believe makes him well-qualified to serve as a director of our Company.

Class III Continuing Directors - Terms Expire in 2024

Michael H. McKay has served as a member of the Board since 2002. Mr. McKay has been an Advisory Partner at Bain & Company since 2009. He also serves as a member of the board of directors of Hubbardton Forge, LLC and served on the board of directors of Big Outdoor Holdings, LLC and Hubbardton Forge, LLC.until 2023. Since joining Bain & Company in 1987, he helped found its Private Equity Group and has evaluated and developed strategies for hundreds of businesses. From 2004 to 2006, Mr. McKay served as Chief Investment Officer of a principal investment firm based in Washington, D.C., making public and private investments, and was Managing Partner of a Boston-based hedge fund from 2006 to 2009. Until 2022, Mr. McKay iswas also a Senior Lecturer at the Brandeis International Business School, where he has served on the faculty since 2010. Mr. McKay received a Master of Business Administration from The University of Chicago Graduate School of Business, where he received the Mayer Prize as top graduating student, and a Bachelor of Arts with high distinction in Economics from Harvard University.

We believe that Mr. McKay’s experience analyzing, financing and investing in public and private companies makes him well-qualified to serve as a director of our Company.

Stefan L. Shaffer has served as a member of the Board since 2018. Mr. Shaffer is the Managing Partner of SPP Capital Partners, a middle market investment banking and asset management firm that he co-founded in 1989. Prior to founding SPP Capital Partners, Mr. Shaffer was a Vice President in the Private Placement Group at Bankers Trust Company from 1986 to 1989, and worked as an attorney with theengaged in private law firm ofpractice at White & Case LLP from 1982 to 1986. Mr. Shaffer received a Juris Doctor from Cornell University Law School and a Bachelor of Arts from Colgate University. We believe that Mr. Shaffer’s experience analyzing, financing and advising public and private companies makes him well-qualified to serve as a director of our Company.

Noreen E. Skelly has served as a member of our Board since 2019. Ms. Skelly currently serves as the Chief Financial Officer for Blue Sky Bank, a commercial bank headquartered in Pawhuska, Oklahoma, with locations throughout Oklahoma and Texas. She previously served as Chief Financial Officer of Broadway National Bank, a commercial bank headquartered in San Antonio, Texas. She previously servedTexas, from August 2021 to August 2022 and as Executive Vice President and Chief Financial Officer of Veritex Holdings, Inc., the publicly traded holding company of Veritex Community Bank, headquartered in Dallas, Texas, from June 2012 through January 2019. Prior to that, Ms. Skelly was the Chief Financial Officer of Highlands Bancshares, Inc., a bank holding company located in the Dallas, Texas area. Her experience includes serving in various senior management positions within the corporate finance functions at Comerica Bank and ABN AMRO / LaSalle Bank. Ms. Skelly began her professional career at the Federal Reserve Bank of Chicago and was promoted to serve as an accounting policy analyst for the Board of Governors of the Federal Reserve System in Washington, D.C. Ms. Skelly received a Master of Business Administration from the University of Chicago Booth School of Business and a Bachelor of Business Administration in finance from the University of Texas at Austin. We believe that Ms. Skelly’s experience as a chief financial officer of a publicly traded company and as a finance executive make her well-qualified to serve as a director of our Company.

Class I Continuing Directors - Terms Expire in 2025

Ned N. Fleming, III is one of the founders of our Company and has served as Executive Chairman of the Board since our inception. He has served as Managing Partner of SunTx since 2001 and also serves as chairman of the board of directors of Anchor Partners, LLC, Cone Machinery Holdings, LLC and RB Fire United, LLC. Mr. Fleming previously served as a member of the board of directors of Big Outdoor Holdings, LLC, Veritex Holdings, Inc., a publicly traded bank holding company, DF&R Restaurants, Inc., a formerly publicly traded restaurant operator, and Spinnaker Industries, Inc., a publicly traded materials manufacturing company. Prior to co-founding SunTx in 2001, Mr. Fleming served as President and Chief Operating Officer of Spinnaker Industries, Inc. until its sale in 1999. Prior to that, Mr. Fleming worked at a Dallas-based private investment firm, where he led acquisitions in the food and beverage and defense industries. Mr. Fleming received a Master of Business Administration with distinction from Harvard Business School and a Bachelor of Arts in Political Science from Stanford University. As a result of his role with our Company since our inception, Mr. Fleming has significant knowledge of us and our industry, which we believe makes him well-qualified to serve as a director of our Company.

Charles E. Owens is one of the founders of our Company and served as our President and Chief Executive Officer and as a member of our Board from our inception until March 2021, when he transitioned to the role of Vice Chairman of the Board. From 1990 until its sale in 1999, Mr. Owens was President and Chief Executive Officer of Superfos Construction U.S., Inc. (“Superfos”), the North American operation of Superfos a/s, a publicly held Danish company. During his tenure at Superfos, he oversaw the successful acquisition and integration of approximately 35 companies, leading Superfos to become one of the largest highway construction companies in the United States. Prior to 1990, Mr. Owens was President of Couch Construction, Inc., a subsidiary of Superfos headquartered in Dothan, Alabama. Mr. Owens received a Bachelor of Business Administration from Troy University. As a result of his role with our Company since our inception, Mr. Owens has significant knowledge of us and our industry, which we believe makes him well-qualified to serve as a director of our Company.

Fred J. (Jule) Smith, III has served as our President and Chief Executive Officer since April 2021 and as a member of our Board since November 2021. Before that, Mr. Smith served as our Chief Operating Officer from October 2020 to March 2021 and as a Senior Vice President of the Company since 2017. From 2005 until October 2020, Mr. Smith also served in various management roles for FSC II, LLC, our North Carolina subsidiary (“FSC”), including as its President from 2009 to 2020. Before joining FSC, Mr. Smith served as Chief Operating Officer of Fred Smith Construction, Inc. from 2005 to 2009. Prior to that, he held various other positions within Fred Smith Construction, Inc. and also served in the supply corps of the U.S. Navy. Mr. Smith received a Master of Business Administration and a Bachelor of Arts in History from Wake Forest University. We believe that Mr. Smith’s extensive experience in our industry and tenure as a key officer of our Company make him well-qualified to serve as a director of our Company.

Class II Continuing Directors - Terms Expire in 2026

Craig Jennings has served as a member of the Board since 2017. Since 2001, he has been a partner and Chief Financial Officer of SunTx. Prior to co-founding SunTx, Mr. Jennings was Vice President of Finance and Treasurer of Spinnaker Industries, Inc., a publicly traded materials manufacturing company, until its sale in 1999. Prior to that, Mr. Jennings held senior finance positions at a publicly traded oil field services company and a publicly traded food and beverage company, and also was a Senior Audit Manager with Ernst & Young LLP. Mr. Jennings received his Bachelor of Business Administration from the University of Toledo and is a Certified Public Accountant. We believe that Mr. Jennings’ investment, financial and directorship experience makes him well-qualified to serve as a director of our Company.

Mark R. Matteson has served as a member of the Board since our inception. Since 2001, he has been a partner of SunTx. Prior to co-founding SunTx in 2001, Mr. Matteson was Vice President of Corporate Development of Spinnaker Industries, Inc., a publicly traded materials manufacturing company, until its sale in 1999. He currently serves as chairman of the board of directors of Freedom Truck Finance, LLC and as a member of the board of directors of Anchor Partners, LLC. Mr. Matteson received a Master of Business Administration from Georgetown University and a Bachelor of Arts in Foreign Service and International Politics from The Pennsylvania State University. As a result of his role with our Company since our inception, Mr. Matteson has significant knowledge of us and our industry, which we believe makes him well-qualified to serve as a director of our Company.

Board Skills, Experience and Diversity

At Construction Partners, weWe value diversity throughout our Company, including on our Board, and seek to achieve a mix of Board members that represents a diversity of backgroundbackgrounds and experience.experiences. We believe that diversity among the members of our Board is an integral component of effective corporate governance, improves the quality of decision-making and strategic vision, and represents the kind of company we aspire to be. Our Board is representative of a diverse group of backgrounds, viewpoints and ages. As described further below under the heading “Nomination and Consideration of Director Candidates,” we consider candidates for Board service first on the basis of merit, while giving due consideration to diversity criteria.

The table below summarizes certain key qualifications, skills and attributes possessed by our directors that support their respective contributions to our Board. A mark indicates a specific area of focus or expertise on which the Board particularly relies. Not having a mark does not mean the director does not possess that qualification or skill. Our directors’ biographies describe each director’s background and relevant experience in more detail.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Skill or Experience | | Fleming | | Jennings | | Matteson | | McKay | | Owens | | Shaffer | | Skelly | | Smith |

| Leadership | | ü | | ü | | ü | | ü | | ü | | ü | | ü | | ü |

| Finance/Accounting | | ü | | ü | | ü | | ü | | ü | | ü | | ü | | ü |

| Government Relations | | | | | | | | | | ü | | ü | | | | ü |

| Insurance | | ü | | | | ü | | | | | | | | | | ü |

| Heavy Industry | | ü | | | | ü | | ü | | ü | | | | | | ü |

| Investor Relations | | ü | | ü | | ü | | ü | | ü | | ü | | ü | | |

| Investments | | ü | | ü | | ü | | ü | | ü | | ü | | ü | | |

| HR / Executive Compensation | | ü | | ü | | ü | | | | ü | | ü | | | | |

| Sustainability / ESG | | ü | | | | | | | | ü | | ü | | | | ü |

| Risk Management | | ü | | ü | | ü | | ü | | ü | | ü | | ü | | ü |

| Capital Markets | | ü | | ü | | ü | | ü | | | | ü | | ü | | |

In accordance with Nasdaq Listing Rule 5605(f),5606, the following chart sets forth certain self-identified personal demographic characteristics of our directors.directors as of the dates indicated.

Board Diversity Matrix (As of December 31, 2021)

2023 and 2022) | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Number of Directors | | | | | 8 | | | |

| | Female | | Male | | Non-Binary | | Did Not Disclose Gender |

| Part I: Gender Identity | | | | | | | | |

| Directors | | 1 | | 7 | | — | | — |

| | | | | | | | |

| Part II: Demographic Background | | | | | | | | |

| White | | 1 | | 7 | | — | | — |

Information about Executive Officers Who Are Not Also Directors

The following table sets forth certain information about our executive officers who are not also directors. Executive officers are elected annually by the Board to serve at the Board’s discretion until their successors are duly elected and qualified or until their earlier death, resignation, retirement, disqualification or removal.

| | | | | | | | | | | | | | |

| Name | | Age | | Position |

R. Alan PalmerTodd K. Andrews | | 6961 | | ExecutiveChief Accounting Officer |

| M. Brett Armstrong | | 62 | | Senior Vice President |

| J. Ryan Brooks | | 35 | | Senior Vice President, Legal |

| Robert P. Flowers | | 64 | | Senior Vice President |

| John L. Harper | | 59 | | Senior Vice President |

| Gregory A. Hoffman | | 58 | | Senior Vice President and Chief Financial Officer |

Todd K. Andrews | | 59 | | Chief Accounting Officer |

M. Brett Armstrong | | 60 | | Senior Vice President |

J. Ryan Brooks | | 33 | | Senior Vice President, Legal |

Robert P. Flowers | | 62 | | Senior Vice President |

John L. Harper | | 57 | | Senior Vice President |

Gregory A. Hoffman | | 56 | | Senior Vice President, Finance |

R. Alan Palmer is one of the founders of our Company and has served as our Executive Vice President and Chief Financial Officer since 2006. Between 2001 and 2006, Mr. Palmer provided consulting services to the Company. Prior to 2000, Mr. Palmer was Vice President and Chief Financial Officer of Couch Construction, Inc. and Superfos. Mr. Palmer received a Bachelor of Science in Accounting from Auburn University.

Todd K. Andrews has served as our Chief Accounting Officer since December 2018. Prior to that, Mr. Andrews served as the Company’s Controller, a role that he held since 2008. Before joining the Company, Mr. Andrews served for more than nine years as Chief Financial Officer of Graceba Total Communications, Inc., a provider of cable television and broadband internet services, and in accounting roles at two banking institutions. Mr. Andrews is a Certified Public Accountant and holds Bachelor of Science degrees in Accounting and Computer Science from Troy University.

M. Brett Armstrong has served as our Senior Vice President since 2017 and2017. Prior to that, Mr. Armstrong served in various management positions at Wiregrass Construction Company, Inc. (“WCC”), our Alabama subsidiary, since 2000, including as its Chief Operating Officer since 2010. Prior to joining WCC, he was Area Manager over the Columbus, Georgia division of Ashland Paving and Construction, Inc. Prior to that, he was Area Manager over the Columbus, Georgia division of Superfos. Mr. Armstrong holds a Bachelor of Science in Civil Engineering from Auburn University.

J. Ryan Brooks has served as our Senior Vice President, Legal, since 2018. Prior to joining the Company, Mr. Brooks was in private law practice at Maynard, Cooper & Gale, P.C. in Birmingham, Alabama, where he represented both public and private companies in a variety of corporate matters, including mergers and acquisitions, securities offerings and regulatory compliance. Mr. Brooks holds a Juris Doctor from Vanderbilt University Law School and a Bachelor of Science in Accounting from Auburn University.

Robert P. Flowers has served as our Senior Vice President since 2017 and has served as President of C.W. Roberts Contracting, Inc., our Florida subsidiary, since joining our Company in 2013. Prior to joining our Company, he was Executive Vice President of Estimating and Construction for Barlovento, LLC, a general contractor performing civil and commercial construction throughout the United States. Prior to that, Mr. Flowers was the Georgia Platform President of Superfos.